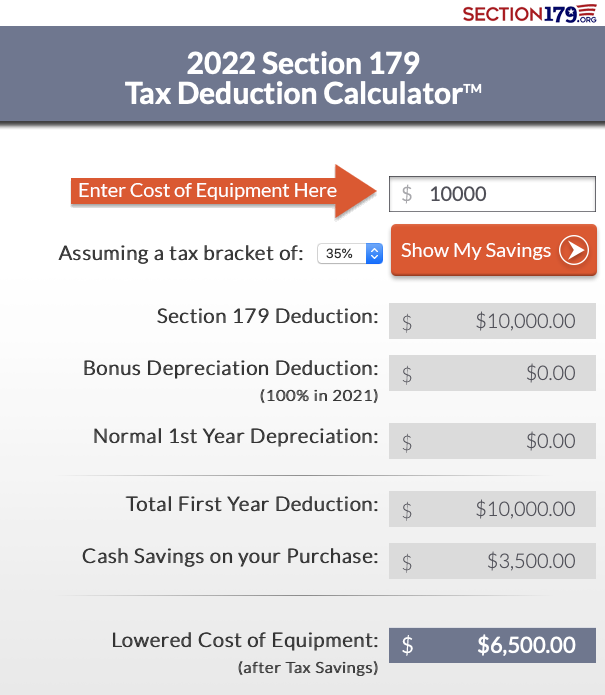

The section 179 tax deduction is an immediate expense deduction that business owners can take for business equipment purchases instead of capitalizing and depreciating the asset over time. Qualifying purchases include those related to depreciable assets such as equipment, vehicles, and software. All Allenbuild instruments would be applicable to Section 179 tax relief.

The deduction can be taken for the full price regardless of if the piece of equipment is purchased or financed. The maximum deduction is $1,080,000 and property purchased to $2,700,000 for the year 2022.